Carmakers say plans to lower air pollution limits would cost them too much, but new analysis shows European car manufacturers are making record profits and paying out unprecedented amounts to CEOs and shareholders.

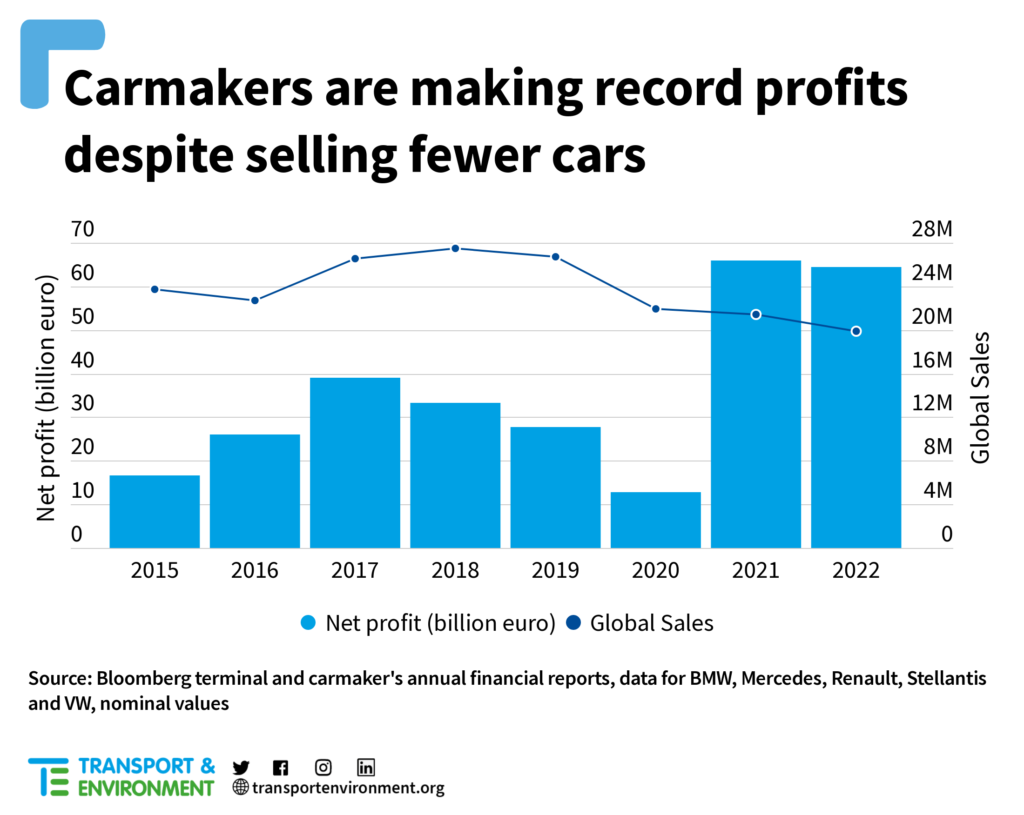

Together, Europe’s five big carmakers [1] have more than doubled their annual profits since 2019 to €64 billion. Transport & Environment (T&E) said the car industry’s fight against tighter pollution rules puts corporate greed before public health.

Current EU proposals to tighten air pollution rules would cost at most €150 per car. [2] Lawmakers are debating the new ‘Euro 7’ limits for toxic emissions from road transport which cause 70,000 premature deaths every year. T&E is advocating more ambitious pollution limits which would cost Europe’s largest carmaker, Volkswagen, €5.7 billion over the entire lifetime [3] of the regulation – just 37% of its 2022 profits, according to the analysis. [4] The EU Commission has proposed weak rules which fall far short of its own experts’ recommendations and maintain the same emission limits set for petrol cars more than a decade ago. But even this proposal is opposed by the car industry which claims it would be too expensive to comply with.

The five biggest European carmakers have all increased their profit margins since before the pandemic despite selling 25% fewer cars overall. BMW almost tripled its profit margin in 2022 compared to 2019 while Stellantis more than doubled its margin – as part of an industry-wide switch from selling more mass-market cars to selling fewer but expensive premium vehicles. T&E said carmakers are scrapping more affordable cars like the Fiat Punto for the sake of profits, but they still argue that EU air pollution rules would make vehicles too expensive for ordinary drivers.

Advertisement

Anna Krajinska, vehicle emissions and air quality manager at T&E, said: “We don’t begrudge carmakers their record profits, but claims that they cannot afford cheap pollution fixes are simply corporate greed. The auto industry is maximising profits by selling more expensive premium vehicles while at the same time pretending pollution rules would make cars unaffordable. EU lawmakers need to put public health before the industry’s money grab.”

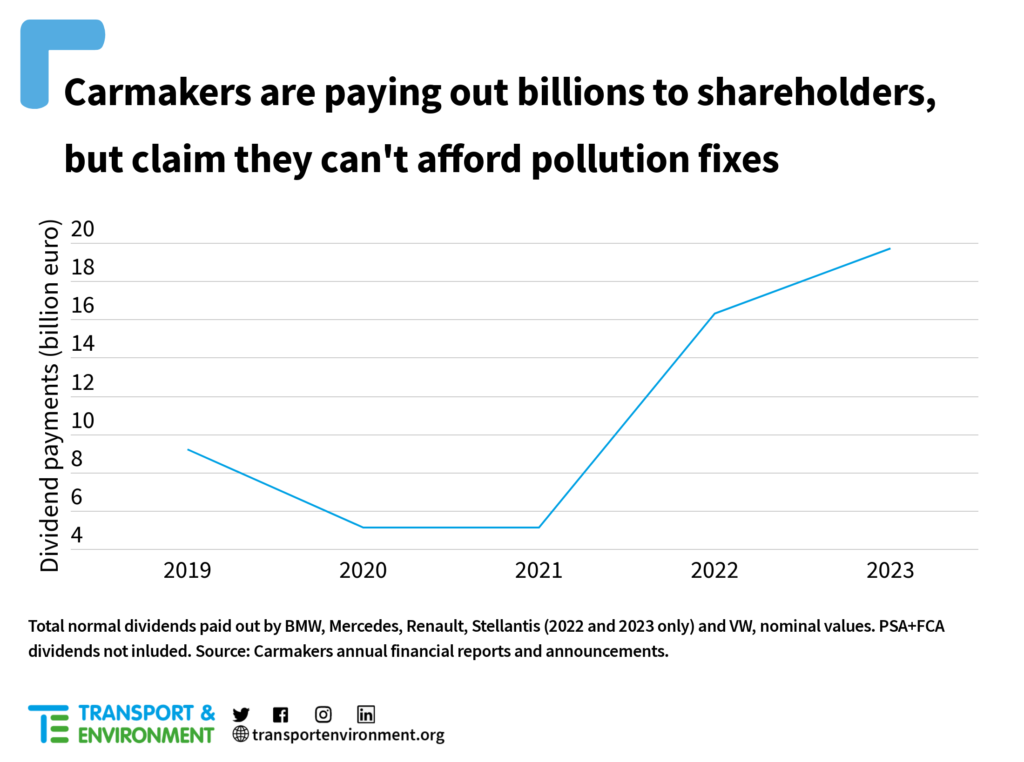

The five companies are also paying out €19.7 billion in shareholder dividends and €7.5 billion in stock buybacks this year, aimed at boosting their share price. Stellantis plans to spend €5.7 billion on dividends and buying back shares – more than the total cost for the carmaker to comply with tighter air pollution rules. T&E said it exposes as false the carmakers’ claims they cannot afford to invest in pollution control upgrades because it would syphon investments away from electrification.

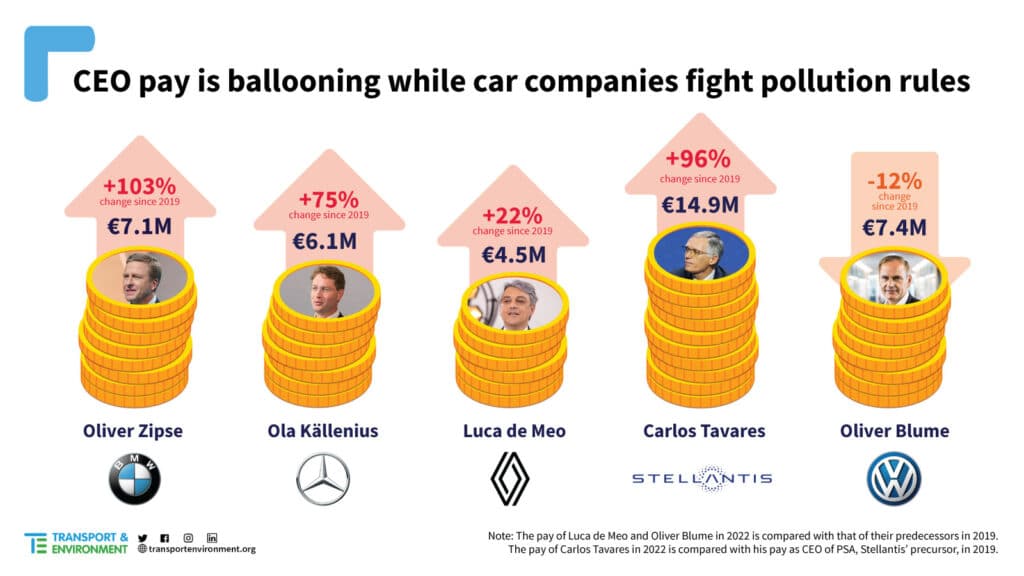

While auto companies have prioritised selling more profitable vehicles, executive pay has ballooned 50% on average since the year before Covid. Stellantis CEO Carlos Tavares was paid €14.9 million last year – almost twice as much as when he was head of its precursor, PSA, in 2019. Mercedes boss Ola Källenius made 75% more last year than in 2019. Only Volkswagen head Oliver Blume made less in 2022 than his predecessor in 2019, but the company is planning to increase his maximum pay by a quarter.

T&E called on the European Parliament and EU governments, which are debating the proposed Euro 7 pollution rules, to raise their ambition to at least be in line with the EU Commission’s own impact assessment. The rules will regulate the toxic pollution of the 100 million cars expected to be sold before the EU’s 2035 phase-out of combustion engines – and perhaps even later if e-fuels powered cars are sold.

Anna Krajinska said: “Car companies in the best of financial health should not be allowed to endanger public health while paying out billions to shareholders. These are the last tailpipe pollution rules carmakers will ever have to comply with. It is our only chance to cut toxic emissions from the 100 million polluting cars still to be sold.”

[1] T&E analysed the profits, dividends, stock buybacks and CEO pay of Europe’s five biggest carmakers: Volkswagen Group, Stellantis, Mercedes, BMW, and Renault.

[2] The European Commission assesses the cost of the proposed Euro 7 rules at between €90 and €150 per car.

https://single-market-economy.ec.europa.eu/system/files/2022-11/Euro%207%20factsheet.pdf

[3] The European Commission’s impact assessment analysed the costs based on the regulation’s lifetime being from 2025 to 2050. It assumed that the last combustion engines would be sold in 2035 and the law would require vehicles to comply with limits for 15 years after their sale.

Advertisement

[4] This is based on the European Commission’s Euro 7 Impact Assessment, which finds a more ambitious Euro 7 (than proposed by the Commision) is the optimal policy option for reducing pollution from cars. This includes reducing the limit for toxic NOx pollution from 60 to 30 mg/km and for dangerous particles from 6×1011/km to 1×1011/km.

Read more: Analysis: Euro 7: Carmakers’ record profits made at expense of human health