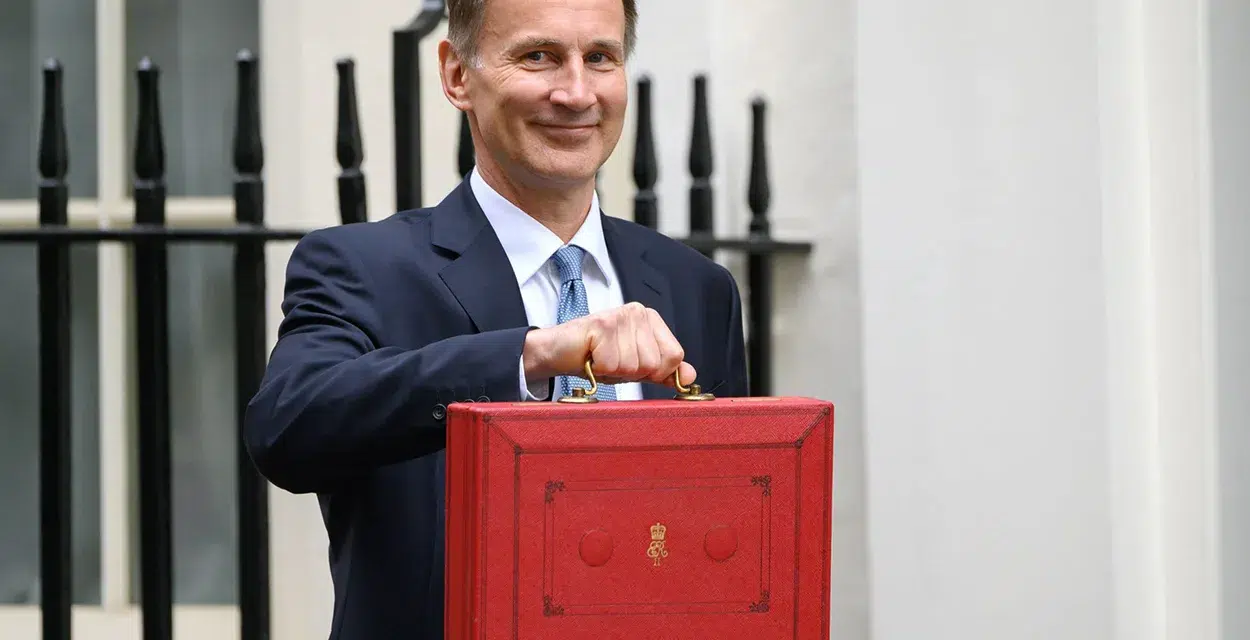

The Chancellor, Jeremy Hunt, will deliver his Spring Budget to Parliament on Wednesday 6th March. In the current economic climate, transport and logistics businesses and employees alike need certainty and reassurance above all from this Budget.

The key challenge for many seems to be deciding how and when to re-invest in their fleet. The cost of borrowing has gone up, and there is uncertainty in the economy locally (interest rates, inflation, possible change in government, cross border challenges, staff shortages) and globally (shipping lanes being affected, war, displacement of people). This all affects confidence in decision making. Providing support and addressing some of the points below would provide confidence in an important sector to the UK economy.

A long-term plan for the industry: We would support a longer-term investment plan for the freight industry. A plan which spans several terms of Government office, enabling sufficient time to implement a futuristic and sustainable infrastructure. Short term planning is ineffective for a key sector for UK businesses and economy. This should involve a “multimodal” approach to the logistics industry looking at how road, sea, rail and air can play their part.

The impact of Brexit: The ongoing impact of Brexit is resulting in continued disruption and delays at cross border checks. Increasing the number of trade agreements, and actively negotiating better cross border processes, will help logistics businesses in the UK.

Advertisement

Skills and staffing: Skills and resource shortages continue to impact the T&L industry and more investment, potentially tax incentives, are needed to encourage new recruits into the industry. The shortfall of drivers in the haulage industry continues to be a significant issue and new investment and initiatives are desperately needed. Investment is also needed in providing safe and secure parking spaces for truckers in the UK as there is a significant shortage and these types of issue do not help with recruitment either. Expansion of the apprenticeship levy would also help fill the skills gap and fund approved vocational courses.

Green investment: SMEs in particular require additional tax incentives to help them compete with larger businesses on sustainability. Enhanced tax incentives for SMEs investing in greener fleets would be welcome. There is potential for emissions rebates to encourage the take up of greener fleets and fuels (biodiesel “HVO” may be part of the solution towards net zero). Additional investment in the infrastructure for electric vehicles is required to encourage further investment by businesses in greener vehicles.

For more information about Menzies LLP, visit www.menzies.co.uk.