The current state of gig workers’ financial exclusion and the call for financial institutions to address a data disconnect.

Gig workers financial exclusion

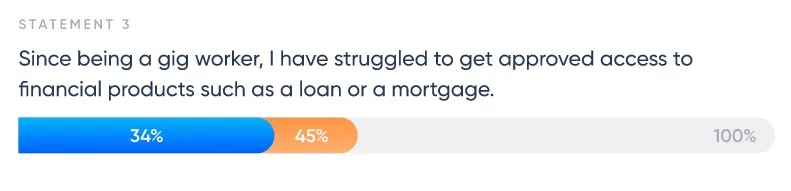

As of the end of 2022, there were over 4 million gig workers in France and 7.21 million in the UK with that figure expected to reach 14.86 million workers by 2026. Despite their growing contribution to the economy, gig workers are struggling to gain access to financial services, despite their affordability.

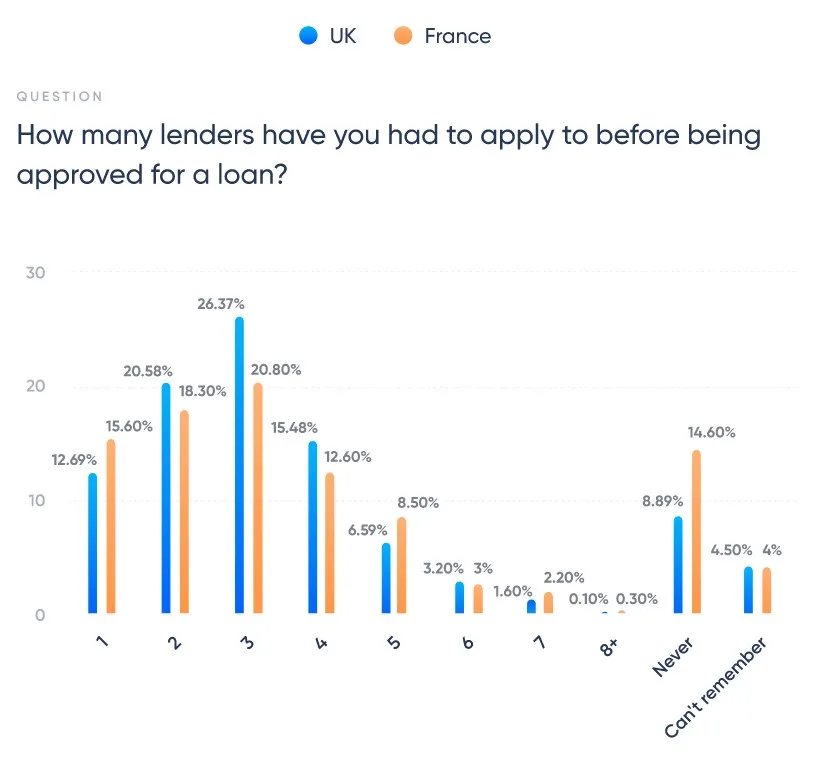

60% of UK gig workers had to apply to 3 or more lenders before being approved for a loan.

47% of French gig workers had to apply to 3 or more lenders before being approved for a loan.

Advertisement

Only 12% (UK) / 15% (FR) of gig workers have been approved for a loan on their first try.

Financial service accessibility concerns

Most gig workers trust that their banks have a complete picture of their income streams. However, the majority feel that their bank does not consider all of their income and employment data. This is a result of a lack of transparency in the application process.

Gig workers are questioning whether they have an equal opportunity when applying to a financial service. A majority of gig workers are conscious that their work situation is holding them back and that PAYE, full-time workers have preferential access to financial services.

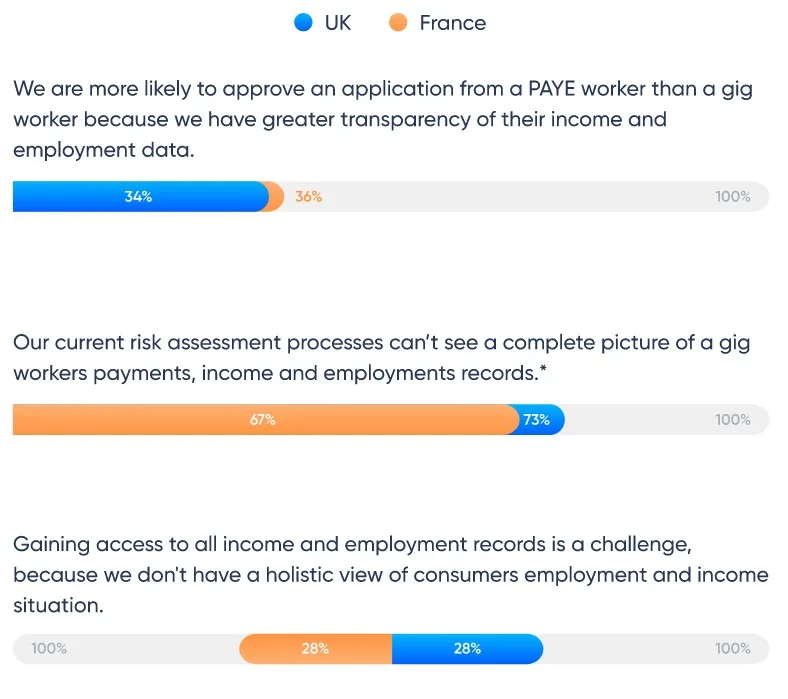

The banks data disconnect

Data is a critical asset for financial institutions to validate an application accurately and fairly. However, financial institutions report a data disconnect between current risk assessment processes and gig workers income and employment records.

Of those financial institutions surveyed, a quarter say it is a struggle to gain access to all income and employment records to assess all the risks of an individual’s financial credibility when assessing an application.

*23% of UK and 33% of FR respondents agreed with the statement ‘Our current risk assessment processes can see a complete picture of a worker’s payments, income and employments records.

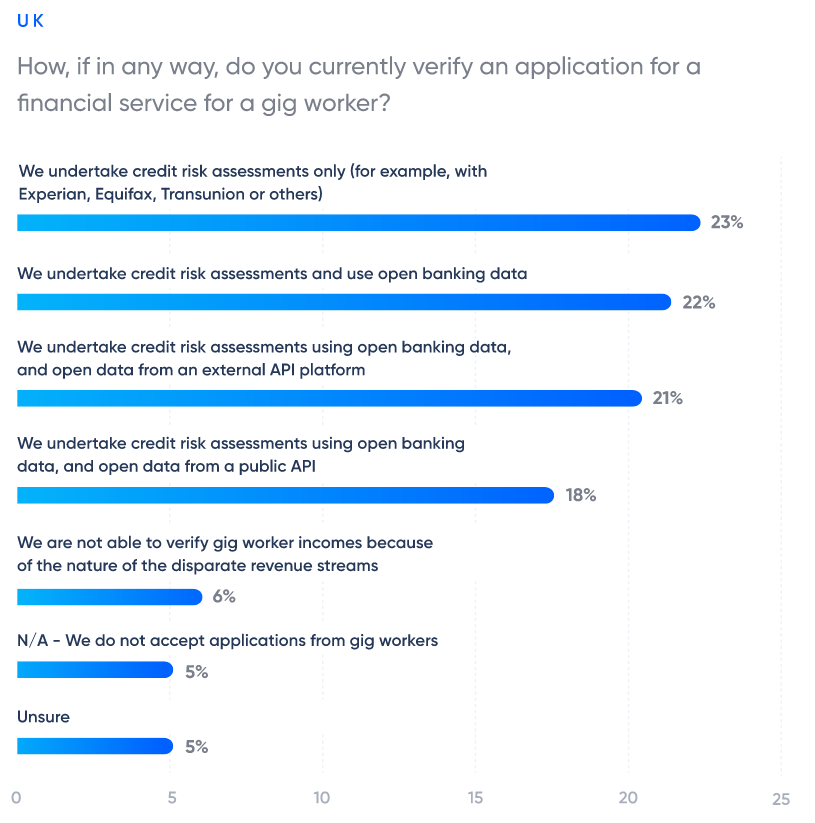

45% of UK banks only rely on external credit bureaus and open banking data to make a decision on their incoming credit applications. This does not provide a holistic view of a gig workers income streams and aligns with the fact that 73 % of UK financial institutions state their current risk assessment processes can’t see a complete picture of a gig workers payments, income and employment records.

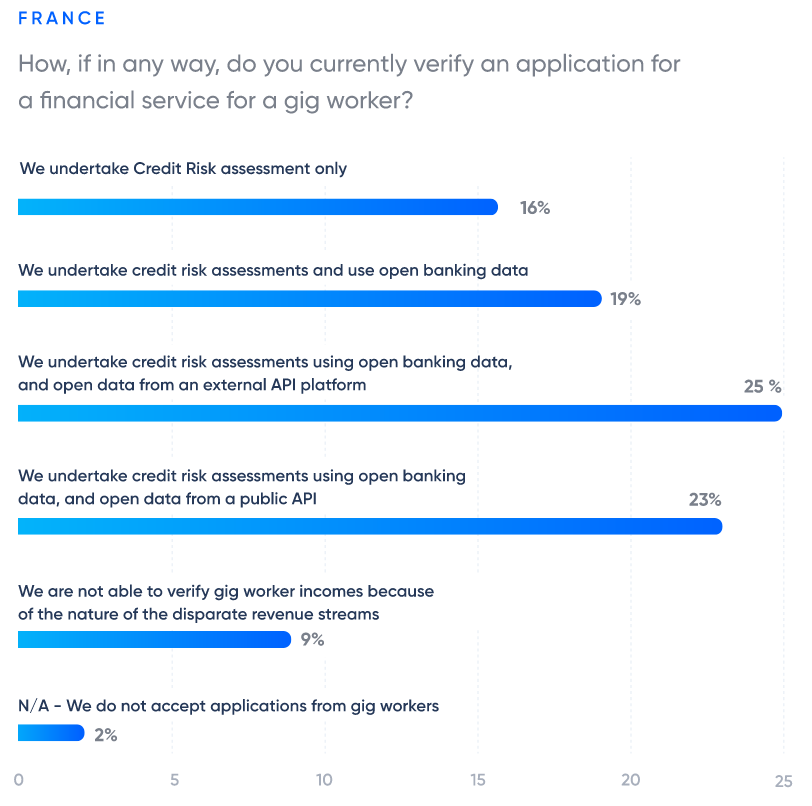

French banks are slightly more cautious in verifying credit applications.

35% of them rely solely on basic credit risk assessments and open banking data. 47% of French Banks state that they also consider open data from external and public APIs in order to verify gig workers income streams. This seems insufficient, as 67% of Financial institutions in France say that their current risk assessment processes do not provide a complete picture of a gig workers activity.

Advertisement

The growing impact of financial inequality

While the majority of gig workers are reluctant to give up their flexibility and return to a traditional employment situation, gig workers chose to take on more gig working jobs in order to manage financially in the last 12 months.

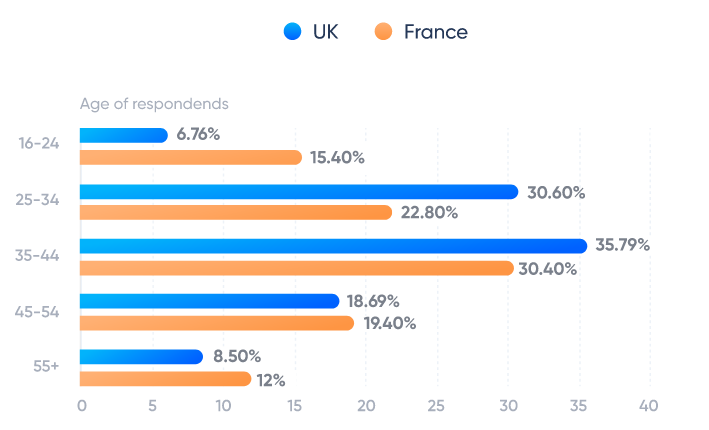

Gig workers Geographical data

UK

East of England, Greater London, East Midlands, West Midlands, North East, North West, Northern Ireland, Scotland, South East, South West, Wales, Yorkshire and the Humber.

France

Auvergne-Rhône-Alpes, Bourgogne-Franche-Comté, Bretagne, Centre-Val de Loire, Corse, Grand-Est, Hauts-de-France, Île-de-France, Normandie, Nouvelle-Aquitaine, Occitanie, Pays de la Loire, Provence-Alpes-Côte d’Azur.

2001 gig workers surveyed

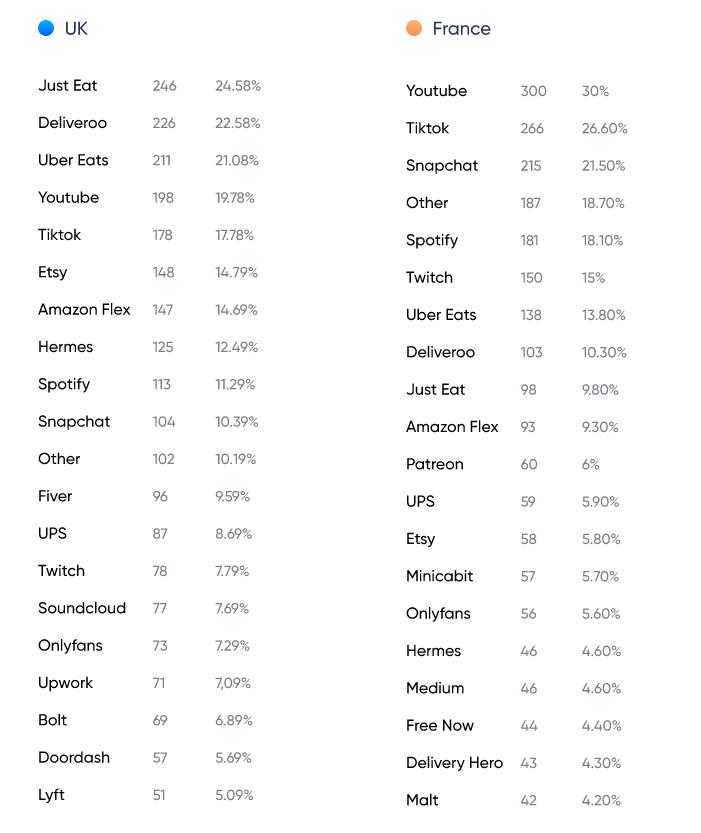

Most used platforms of surveyed gig workers

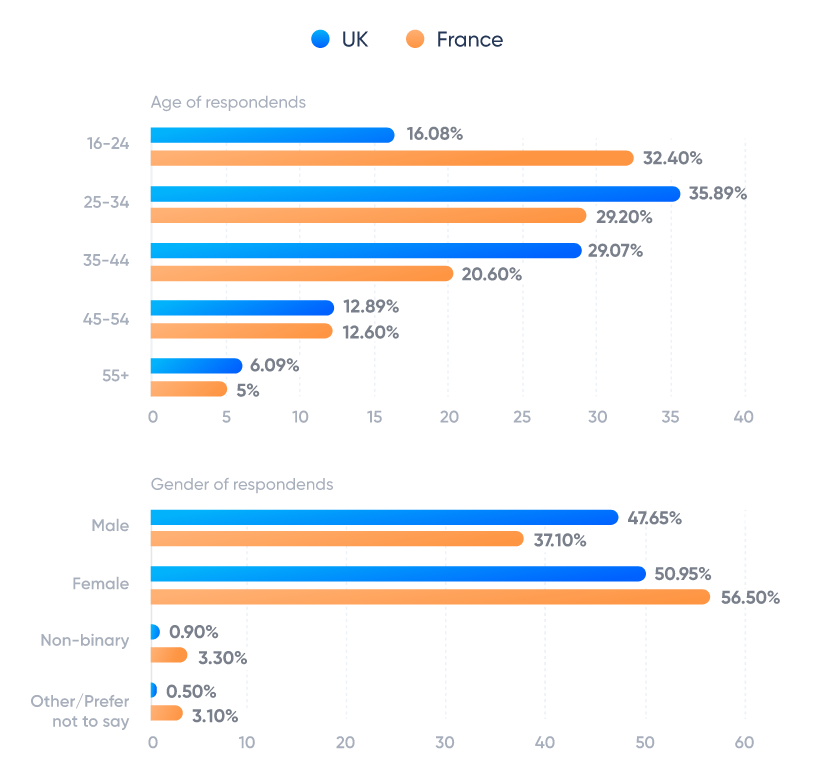

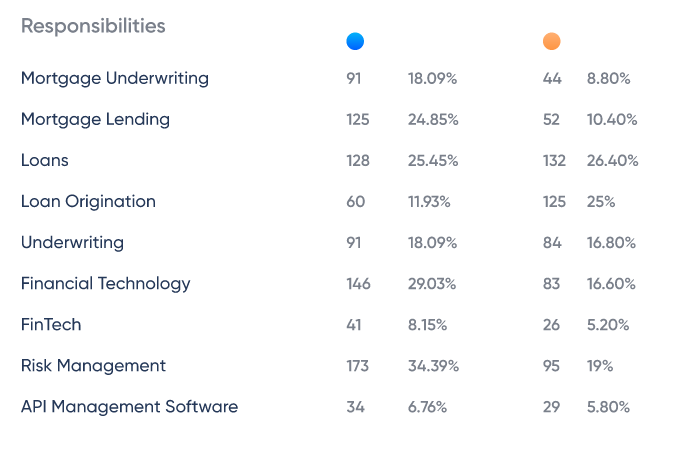

Financial institutions Demographic data

Who work in financial institutions in UK and France

About Rollee – We are on a mission to make income data collection simple, reliable and fast.

To establish fair scoring models that cater for all types of workers, financial institutions must gain swift and seamless access to alternative data points that accurately reflect the financial stability of self-employed individuals from various working categories.

Advertisement

We help lenders, banks and other financial institutions to get a fair assessment of gig workers income.

To find out more or to chat with one of the Rollee team, simply click on the banner below.