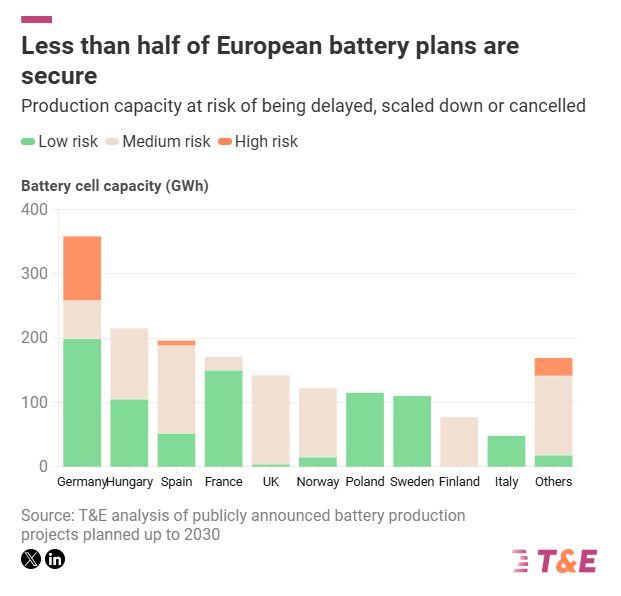

But over half of Europe’s battery production plans are at risk without stronger government action.

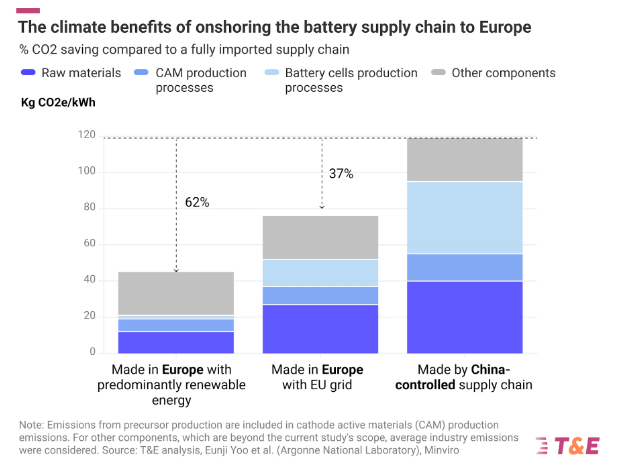

Onshoring the EV supply chain to Europe would cut the emissions of producing a battery by 37% compared to a China-controlled supply chain, according to new analysis by Transport & Environment (T&E). This carbon saving rises to over 60% when renewable electricity is used. Producing Europe’s demand for battery cells and components locally would save an estimated 133 Mt of CO2 between 2024 and 2030, equivalent to the total annual emissions of Czechia.

But less than half (47%) of the lithium-ion battery production planned for Europe up to 2030 is secure, the report also finds. This is up from one-third a year ago following a raft of measures put in place to respond to the US Inflation Reduction Act. The remaining 53% of announced cell manufacturing capacity is still at medium or high risk of being delayed, scaled down or cancelled without stronger government action.

Julia Poliscanova, senior director for vehicles and emobility supply chains at T&E, said: “Batteries, and metals that go into them, are the new oil. European leaders will need laser sharp focus and joined-up thinking to reap their climate and industrial benefits. Strong sustainability requirements, such as the upcoming battery carbon footprint rules, can reward local clean manufacturing. Crucially, Europe needs better instruments under the European Investment Bank and EU Battery Fund to support gigafactory investments.”

Advertisement

France, Germany and Hungary have made the most progress in securing gigafactory capacity since T&E’s previous risk assessment last year. [1] In France, ACC started production in Pas-de-Calais last year while plants by Verkor in Dunkirk and Northvolt in Schleswig-Holstein, Germany, are going ahead thanks to generous government subsidies.

Finland, the UK, Norway and Spain have the most production capacity at medium or high risk due to question marks over projects by the Finnish Minerals Group, West Midlands Gigafactory, Freyr and InoBat. T&E called on lawmakers to help lock in investments by doubling down on EU electric car policies, enforcing strong battery sustainability requirements that reward local manufacturing, and beefing up EU-level funding.

Securing other parts of the battery value chain will be even more challenging given China’s dominance and the EU’s nascent expertise. The report finds Europe has the potential to manufacture 56% of its demand for cathodes – the battery’s most valuable components – by 2030, but only two plants have started commercial operations so far. By the end of this decade, the region could also fulfil all of its processed lithium needs and secure between 8% and 27% of battery minerals from recycling in Europe. But T&E said processing and recycling plants need EU and state support to scale quickly.

Julia Poliscanova said: “The battery race between China, Europe and the US is intensifying. While some battery investments that were at risk of being lured away by US subsidies have been saved since last year, close to half of planned production is still up for grabs. The EU needs to end any uncertainty over its engine phase-out and set corporate EV targets to assure gigafactory investors that they will have a guaranteed market for their product.”