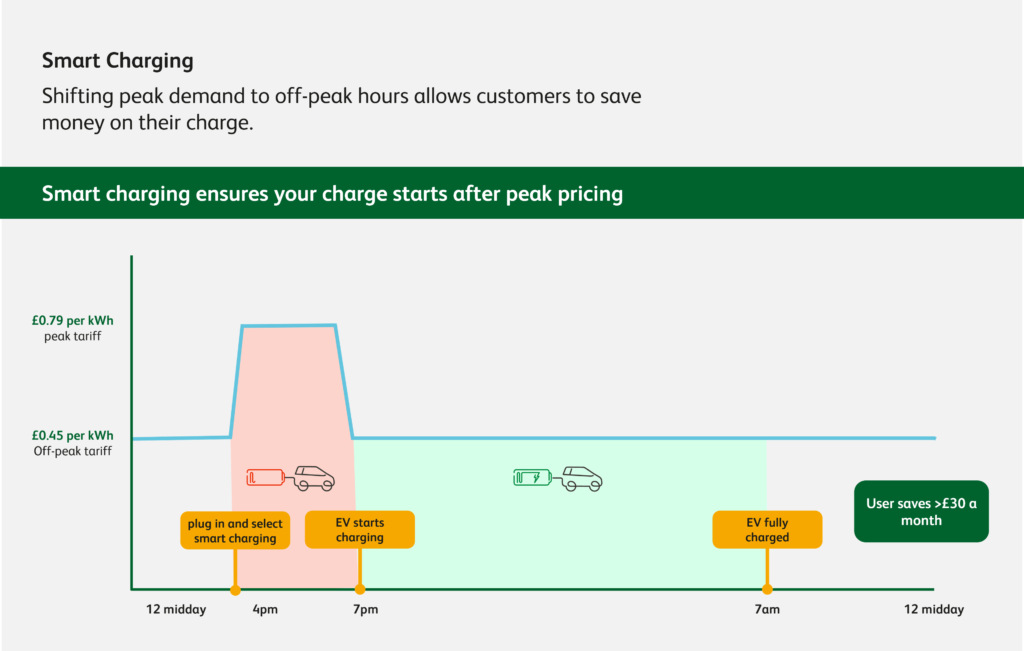

ubitricity’s Smart charging allows users to schedule their charge to an off-peak time, such as between 7pm – 4pm which is priced at a cheaper rate. Whilst Smart charging is widely available in home chargers, this is the largest public smart charging roll-out if its kind.

UK managing director of ubitricity Toby Butler explained “We know from our data that most of our users like to charge their cars at the end of their working day – coinciding with when energy demand is already at its peak. Smart charging allows our EV users to plug in at their usual time but schedule their charge to start after peak hours, when energy prices are cheaper.”

How is it being used?

ubitricity revealed that users were already responding well to Smart charging, with over 45% of eligible charging sessions selecting to use the feature. Since the roll-out to over 4000 charge points began in December 2022, the average Smart charging user has saved £4.00 on their charging session. A user charging twice a week would save £32 a month.

Advertisement

Why is Smart charging important?

UK Managing director of ubitricity Toby Butler said “It is estimated that over 8 million households in the UK have no access to private or off-street parking [2], we believe that residents should be able to access cheaper public charging options similar to EV drivers who can charge at home. In a time where the price of energy is effecting everyone, we wanted to try and innovate new ways to pass possible energy savings onto our customers.”

“Rolling out smart charging will be essential in the UK’s switch to EVs,”

“Rolling out smart charging will be essential in the UK’s switch to EVs” said Butler. There are now over 100,000 Electric vehicles registered in the UK [3], and this number is expected to rise exponentially in the coming years as electric vehicles become cheaper and public changing infrastructure improves. “

Ian Cameron, Director of Customer Service and Innovation at UK Power Networks, said: “Our aim is to make it easier for everyone to make the switch to an EV regardless of where they park and whether they have access to the own off-street charger. This is a game-changing development that will open up public charging at a lower cost to a large number of people.

Whilst there is no doubt the electrification of transport has huge benefits to the environment an influx of electric vehicles will have implications on our national power. We believe that Smart charging will play an integral role in the expansion of EV charging infrastructure in the UK, incentivising grid-friendly public charging whilst simultaneously providing savings for customers who rely on on-street charging.

The software was originally trialled on 300 charge points in Westminster. Westminster currently have over 1,500 ubitricity lamppost and bollard charge points across the borough, which made it the ideal location to trial the new technology. This new trial with ubitricity was a significant step in delivering this increased charging provision in the borough. Westminster City Council is planning to increase the number of Electric Vehicle (EV) charging points in Westminster to over 2,000 charging points, the most in the country. The Council is targeting at least 500 of this new wave to be installed by March 2023. This new trial with ubitricity is a significant step in delivering this increased charging provision in the borough.

Cllr Paul Dimoldenberg, Cabinet Member for City Management and Air Quality at Westminster City Council said: “Being in the heart of London, most of our residents don’t have off-street or private parking so this new smart charging trial with ubitricity, which offers off-peak charging sessions at a cheaper rate, will save our residents money during this cost of living crisis and at a time where energy prices are so high.”

Advertisement

“Westminster has some of the poorest air quality of any local authority. Reducing travel by petrol or diesel cars is one of the most effective ways to improve air quality and the council wants to see more resident vehicles in Westminster become electric in the future. This new trial, along with our pledge for an additional 500 charging points to be installed across the borough, with a potential stretch target of 1000, is a big step toward reaching this goal.”

To find your nearest ubitricity charge point you can check the charging network map here: https://ubitricity.com/en/driver/charging-network-map/

As electricity supply costs changes from winter to summer seasons, ubitricity will adapt the timings of smart charging to help customer continue to manage their costs.

[1]https://www.zap-map.com/statistics/

[2]https://www.gov.uk/government/publications/electric-vehicle-charging-market-study-final-report/final-report

[3]https://www.smmt.co.uk/vehicle-data/evs-and-afvs-registrations/

Cautionary note

The companies in which Shell plc directly and indirectly owns investments are separate legal entities. In this announcement “Shell”, “Shell Group” and “Group” are sometimes used for convenience where references are made to Shell plc and its subsidiaries in general. Likewise, the words “we”, “us” and “our” are also used to refer to Shell plc and its subsidiaries in general or to those who work for them. These terms are also used where no useful purpose is served by identifying the particular entity or entities. ‘‘Subsidiaries’’, “Shell subsidiaries” and “Shell companies” as used in this announcement refer to entities over which Shell plc either directly or indirectly has control. Entities and unincorporated arrangements over which Shell has joint control are generally referred to as “joint ventures” and “joint operations”, respectively. Entities over which Shell has significant influence but neither control nor joint control are referred to as “associates”. The term “Shell interest” is used for convenience to indicate the direct and/or indirect ownership interest held by Shell in an entity or unincorporated joint arrangement, after exclusion of all third-party interest.

This announcement contains forward-looking statements (within the meaning of the U.S. Private Securities Litigation Reform Act of 1995) concerning the financial condition, results of operations and businesses of Shell. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Shell to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. These forward-looking statements are identified by their use of terms and phrases such as “aim”, “ambition”, ‘‘anticipate’’, ‘‘believe’’, ‘‘could’’, ‘‘estimate’’, ‘‘expect’’, ‘‘goals’’, ‘‘intend’’, ‘‘may’’, “milestones”, ‘‘objectives’’, ‘‘outlook’’, ‘‘plan’’, ‘‘probably’’, ‘‘project’’, ‘‘risks’’, “schedule”, ‘‘seek’’, ‘‘should’’, ‘‘target’’, ‘‘will’’ and similar terms and phrases. There are a number of factors that could affect the future operations of Shell and could cause those results to differ materially from those expressed in the forward-looking statements included in this announcement, including (without limitation): (a) price fluctuations in crude oil and natural gas; (b) changes in demand for Shell’s products; (c) currency fluctuations; (d) drilling and production results; (e) reserves estimates; (f) loss of market share and industry competition; (g) environmental and physical risks; (h) risks associated with the identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; (i) the risk of doing business in developing countries and countries subject to international sanctions; (j) legislative, judicial, fiscal and regulatory developments including regulatory measures addressing climate change; (k) economic and financial market conditions in various countries and regions; (l) political risks, including the risks of expropriation and renegotiation of the terms of contracts with governmental entities, delays or advancements in the approval of projects and delays in the reimbursement for shared costs; (m) risks associated with the impact of pandemics, such as the COVID-19 (coronavirus) outbreak; and (n) changes in trading conditions. No assurance is provided that future dividend payments will match or exceed previous dividend payments. All forward-looking statements contained in this announcement are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Additional risk factors that may affect future results are contained in Shell plc’s Form 20-F for the year ended December 31, 2020 (available at www.shell.com/investor and www.sec.gov). These risk factors also expressly qualify all forward-looking statements contained in this announcement and should be considered by the reader. Each forward-looking statement speaks only as of the date of this announcement, 15th February 2023. Neither Shell plc nor any of its subsidiaries undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements contained in this announcement.

The content of websites referred to in this announcement does not form part of this announcement.

We may have used certain terms, such as resources, in this announcement that the United States Securities and Exchange Commission (SEC) strictly prohibits us from including in our filings with the SEC. Investors are urged to consider closely the disclosure in our Form 20-F, File No 1-32575, available on the SEC website www.sec.gov

Advertisement