The new European Commission has committed to phase out fossil fuel subsidies and ensure a just green transition, now it has to deliver on this promise, green group Transport & Environment (T&E) says.

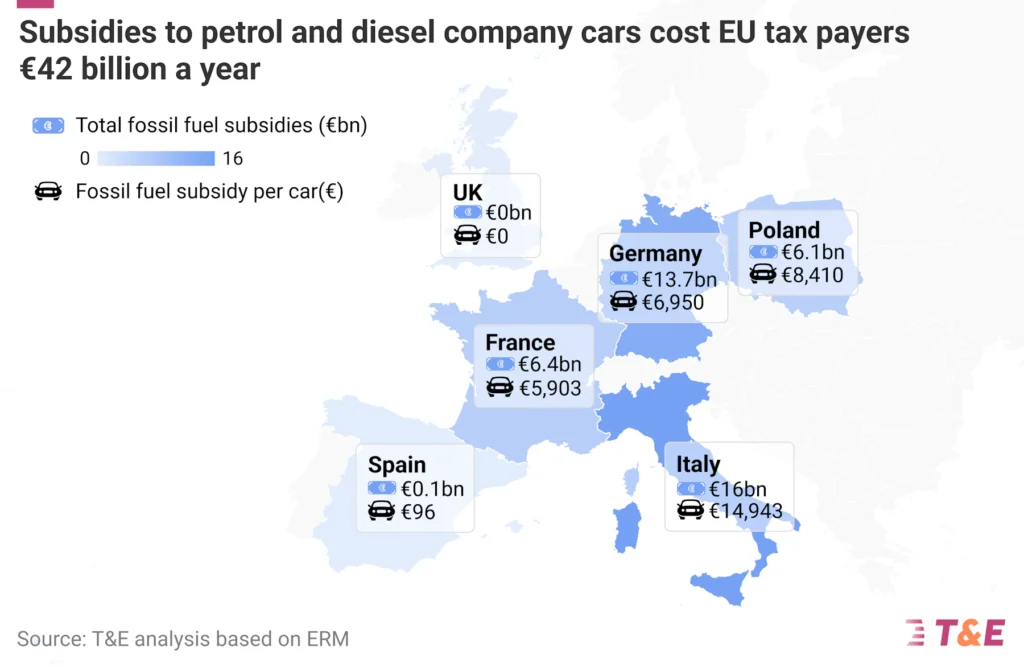

In the five biggest EU countries alone, subsidies for petrol and diesel company cars cost taxpayers €42 billion every year, according to a new study by green group Transport & Environment (T&E). The study by ERM, commissioned by T&E, calculates the effects of the four tax benefits traditionally given to company cars: benefit-in-kind, depreciation write-offs, VAT deductions and fuel cards. These are subsidies not enjoyed by private car owners. Company cars represent 60% of all new car registrations in Europe [1].

Italy, followed by Germany, France and Poland, are the countries that subsidise polluting company cars the most, totalling €16, €13.7, €6.4 and €6.1 billion a year respectively [2][3]. The biggest subsidy happens via benefit-in-kind schemes that continue to incentivise petrol and diesel vehicles.

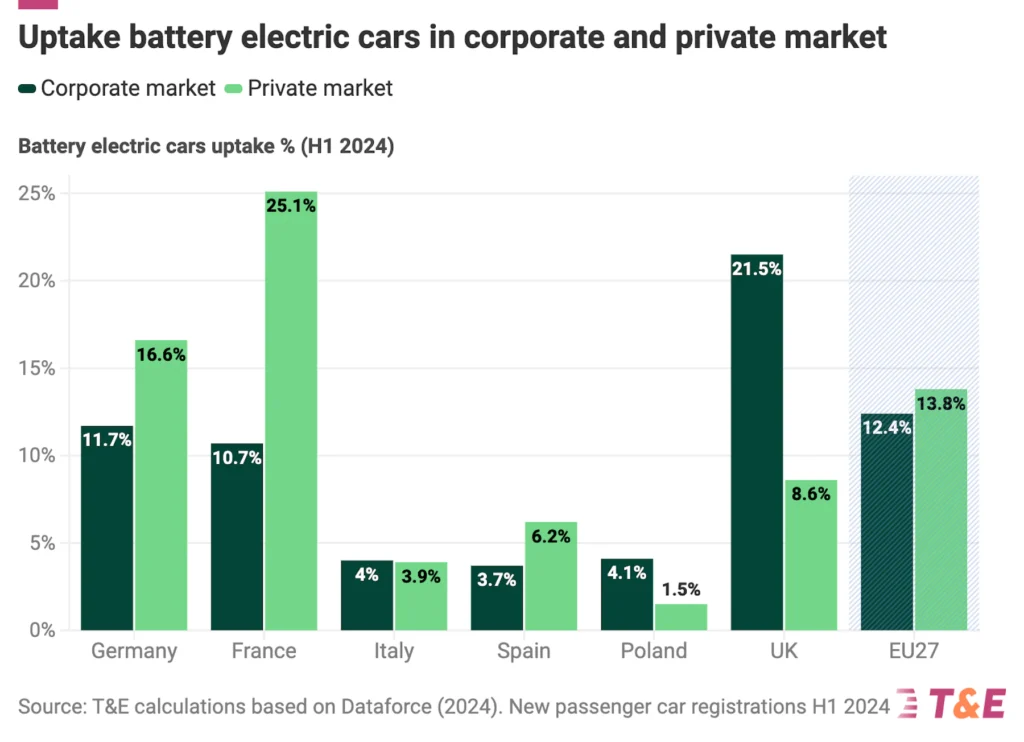

Tax advantages for polluting company cars in the UK and Spain are much lower. Indeed, the UK imposes a strong penalty for petrol and diesel company vehicles through a high benefit-in-kind rate, whilst electric company car drivers pay low taxes. This has helped to boost the uptake of electric company cars which is now at 21.5%. In Spain, the tax benefits for company cars are similar to those for private vehicles, primarily due to a relatively high benefit-in-kind rate. But as Spain offers minimal incentives for companies to opt for electric cars, the uptake of corporate EVs is low (at 3.7%), T&E explains.

Advertisement

SUV company car drivers receive very high fossil fuel subsidies via company car taxation, the study also finds. Compared to a private buyer, they pay up to €8,900 per year less in taxes for driving a polluting SUV. This also explains why companies are registering twice as many climate harming SUVs than private households. Of the total €42 billion, €15 billion go into subsidising SUVs.

Stef Cornelis, director of the electric fleets programme at T&E, said: “ Taxpayers are paying billions every year in tax benefits so company car drivers can drive polluting petrol cars. Many of which are expensive, high-end, high-polluting SUVs. This is bad climate policy and socially unfair. Governments in the UK and Belgium have introduced green tax measures and are phasing out benefits for polluting vehicles. But Governments in Europe’s largest automotive markets are failing to address this absurdity. This is why the European Commission needs to take action.”

Not only do polluting company cars benefit from enormous subsidies, they are also lagging behind in the EU’s green transition efforts. In the first half of 2024, 13.8% of all new private registrations were BEVs in the EU. For corporate registrations, this was only 12.4%. Removing the subsidies for fossil fuel company cars will reverse this trend. The EU heads of state as well as the new candidate Vice-President Teresa Ribera and candidate Climate Commissioner Wopke Hoekstra have previously called for the phase out of fossil fuel subsidies.

In her mission letter to the candidate Commissioner for Sustainable Transport, President von der Leyen has instructed Apostolos Tzitzikostas to come forward with a proposal to make corporate fleets greener. Phasing out fossil fuel subsidies is also mentioned in her letter to candidate Commissioner for Climate Wopke Hoekstra.

T&E calls upon the new European Commission to act now and come forward in 2025 with a Greening Corporate Fleets Regulation that sets binding 2030 electrification targets for large corporate fleets and leasing companies. This will also help to achieve the goals of the upcoming EU Clean Industrial Deal as it will create a lead market for clean technology by boosting demand for EVs while at the same time bring investment certainty for key industrial sectors such as carmakers, battery manufacturers and the power sector.

Stef Cornelis concluded: “President von der Leyen has reconfirmed her support for the Green Deal and called her Commissioner candidates to phase out fossil fuel subsidies. However, the huge tax benefits that wealthy petrol company car drivers still receive in Europe today conflict with that goal. Under her new leadership, the Commission should set electrification targets for large company car fleets, and finally end this tax anomaly. This also fits in the EU’s wider industrial agenda as these targets will boost demand for EVs and create a lead market for clean tech, hereby bringing investment certainty for carmakers and the e-mobility sector overall.”

Advertisement

—

[1] The tax benefits considered in the report apply to salary cars. Salary cars account for 51% of company cars in the EU.

[2] This is the first study of its kind that calculates these subsidies for every car model registered in each of the five countries (over 4,000 combinations in total), rather than relying on archetypal averages or example models.

[3] To come up with the total subsidies, ERM compares two scenarios: a business as usual scenario with the current taxes in place and a counterfactual scenario showing how much salary car drivers would have spent if they were to purchase their vehicles as private buyers. Final figures are based on a scenario in which 80% of the company car mileage is private.